Your Next Move Starts Here

Cyprus Incorporation Made Simple.

Quick and straight-forward remote incorporation of your Cyprus Company. Our specialized teams will assist you through the whole process in a timely and cost-effective manner.

Cyprus offers a beneficial tax regime, making it a top choice for global corporations and entrepreneurs. With a strong track record of international success stories, Cyprus combines strategic EU access, business-friendly regulation, and a thriving professional services ecosystem.

Asterisk Corporate Services, is a licensed & regulated corporate services provider, whose specialized teams can assist you with the formation of a Cyprus Company, answering all of your questions in a timely manner while ensuring a fast incorporation. After incorporation we also provide a range of services (Accounting, VAT, Tax etc) to keep the Company active & compliant in Cyprus.

Here is where our role fits in:

- Prepare all necessary documentation and ensure the Company is smoothly incorporated

- Fast-track your incorporation process

- Provide Directors or other Fiduciary services where required

- Serve as your single point of contact after incorporation for anything you may need

- Ensure ongoing compliance with local regulations and requirements (accounting, audit, tax, etc)

We Manage the Entire Process

Asterisk Corporate Services can assist throughout the process of incorporating a Cyprus Company. We will assist you as follows:

- We will perform a name consultation and apply to have the name approved with the Registrar of Companies

- Draft the Memorandum and Articles of Association, and adjust to your specific needs with different classes of shares, quorum of Directors etc

- Appoint the company’s officers (Directors/Corporate Secretary) and arranging of the registered office address

- Preparation and submission of the required forms and follow up the whole process up until the incorporation is successfully completed

- Provide all relevant documents to you after the incorporation of your new Cyprus Company

- Provision of ongoing services such as Accounting, Tax, VAT, Audit etc to ensure the Company remains compliant.

Please note that there is no need for you to come to Cyprus. Also no originals are required, as the whole process of incorporation can be completed with scanned copies. Our professionals will take care of the whole process ensuring the Company is incorporated in no-time and fuss free. Contact us for more information.

Why Cyprus: 12 Facts for Doing Business in a Strategic EU Location

A Cyprus company is a flexible and powerful vehicle for international entrepreneurs and investors. Cyprus has become a leading EU business hub thanks to a strong legal framework, a modernised tax system (reformed from 1 January 2026), and practical cross-border advantages.

- Corporate income tax: 15% from 1 January 2026 (12.5% up to 31/12/2025).

- Attractive IP Box regime: on qualifying IP income, the effective tax rate can be reduced to ~3% (subject to conditions).

- No withholding tax in most cases; from 2026, defensive withholding may apply to dividends paid to low-tax or non-cooperative jurisdictions (5% / 17%, where applicable).

- Profits from the sale of securities (titles) are generally exempt for Cyprus companies (subject to conditions).

- Dividends received by Cyprus companies are generally exempt, subject to conditions and specific anti-avoidance / low-tax exceptions.

- Stamp duty abolished from 1 January 2026, reducing friction on many agreements.

- A stable and highly developed legal and tax environment, aligned with EU and OECD standards.

- Full EU Member State since 2004, supporting cross-border credibility and EU market access.

- Efficient incorporation and administration, with relatively low annual operating costs compared to many EU jurisdictions.

- Remote-friendly setup: no need to travel to Cyprus to complete the incorporation.

- Flexible structures available (e.g., private limited company, holding structures, group setups), allowing businesses to choose the form that fits their needs.

- Talent-friendly environment: Cyprus continues to offer attractive individual tax incentives for relocating executives and key employees (subject to conditions).

For more information on why to incorporate in Cyprus please click here, or here for updates on the 2026 Cyprus Tax Reform.

HOW YOU CAN BENEFIT BY INCORPORATING WITH ASTERISK

- Tax Optimization: Cyprus has a competitive EU corporate tax rate (15% from 1 Jan 2026) and also favourable tax regimes like the IP Box, which can lower the effective tax rate to ~3%. We will help you where possible to benefit from these regimes.

- Efficient Process: We monitor and streamline the whole incorporation process, saving you time and effort.

- Expert Guidance: With our knowledgeable team of qualified professionals, you receive expert guidance and advice at every stage of the incorporation process and thereafter, ensuring compliance and peace of mind.

- Cost-Effective Solutions: Our competitive pricing and transparent fee structure ensure that you receive cost-effective solutions tailored to your budget and requirements.

- Ongoing Support: After incorporation, we provide ongoing support and assistance to help you navigate the complexities of running a business in Cyprus, ensuring your long-term success.

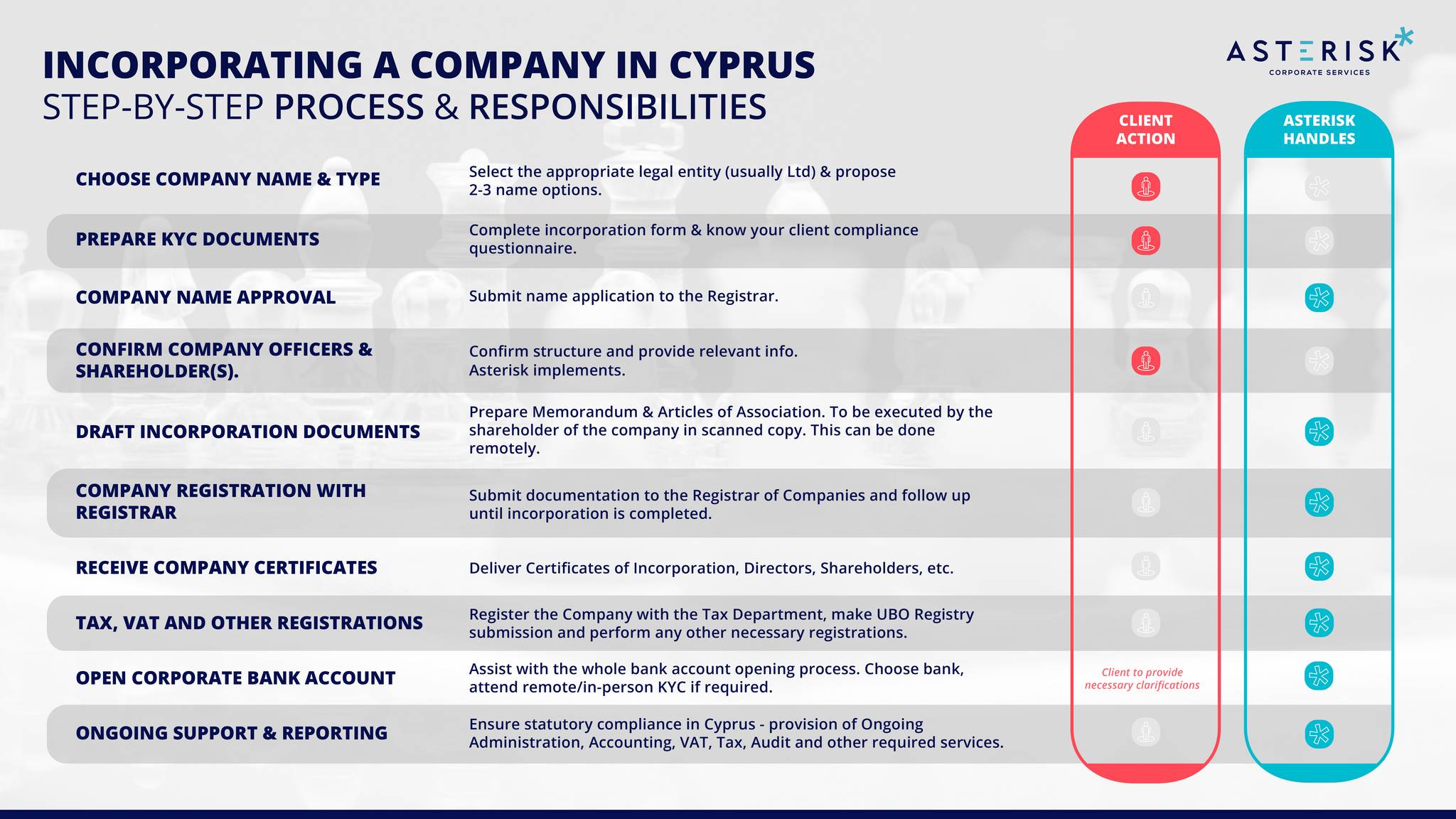

CYPRUS INCORPORATIONS - STEP BY STEP GUIDELINE

Synopsis

Incorporating a company in Cyprus doesn’t have to be complex or time-consuming. With Asterisk Corporate Services as your trusted partner, the entire process becomes streamlined, compliant, and worry-free.

Our team handles each step — from name approval and registrar filings to tax registration and ongoing corporate support — ensuring your Cyprus company is set up efficiently and correctly from the start.

Let us take care of the technicalities so you can focus on growing your business.

📩 Contact us today via the form below to receive tailored guidance and begin your Cyprus incorporation journey today.

Cyprus Company Incorporations – Frequently Asked Questions (FAQ)

Either the EU Membership, the various Tax Benefits for Companies and Expats or the wonderful climate, Cyprus offers a lot of reasons to establish a Company at. Please refer to our post here for more information.

No, you can sign the Memorandum, Articles of Association and any other document which may be required in wet ink and send us the scanned copies for us to be able to proceed with the incorporation.

No, it is not required for a Cyprus Company to have a bank account, but that is recommended so that the Company can pay its expenses. A Cyprus bank account also strengthens tax residency, but Cyprus Companies can also have bank accounts with banks abroad.

The name of your entity should not be too general or already in used, otherwise the Registrar may not approved. We can provide a free consultation on the name, as this is the first step on the incorporation.

Every Cyprus Company must have its own memorandum and articles of association.

The memorandum contains the basic information of the company such as the company name, registered office, the objects of the company and so on. Care must be taken that the first few object clauses are tailored to the specific circumstances and main business objects and activities of the company (we can assist with such).

The articles specify rules about the governance of the internal management of the company and regulations about the rights of the members (appointment and powers of directors, transfer of shares, etc).

Every Cyprus Company needs to have a registered office in the Republic upon incorporation.

The registered office is the place where writs, summonses, notices, orders and other official documents can be served upon the company. It is at the registered office where the company’s register of members is usually kept. This can be the premises of the entity, or such an address can be provided by us as outlined here.

Every Cyprus Company needs to have a corporate secretary, which is responsible for the filings to the Registrar of Companies amongst others. Such services can be provided by us, as outlined here.

The Cyprus Company shall have at least 1 Director and 1 shareholder upon incorporation. Quorum for Directors meetings will be set at the Memorandum and Articles of the Cyprus Company.

No, the share capital initially will be shown as receivable from shareholder and can be settled when the Company has a bank account or when the shareholder pays any expenses on behalf of the entity.

Usually we incorporate entities with authorized share capital of 5,000 ordinary shares of €1 each, and issue 1,000 ordinary shares of €1 each.

Yes, after incorporation shares out of the authorized share capital of the Company can be issued at a premium.

No, usually we incorporate Cyprus Companies with their share capital in €, however, the capital of the Cyprus Co can also be issued in other currencies such as USD$, GBP£ etc.

As a minimum upon incorporation the entity shall register with the Tax Authorities and obtain a Tax Identification Code (TIC), 60 days after incorporation. The Company will also need to submit its UBO information maximum 30 days after incorporation.

There are other registrations that the entity may need such as VAT (if it will conduct vatable activities, or registration with the Social Insurance Authorities if the Company will have employees on its payroll).

The corporate income tax rate in Cyprus is 12.5%. Known for its attractive tax regime, Cyprus has established itself as a favorable destination for businesses seeking a competitive tax environment within the European Union. The 12.5% corporate tax rate, combined with various tax incentives and exemptions, makes Cyprus an appealing jurisdiction for company incorporation. This moderate tax rate, coupled with the country’s strategic location, robust legal framework, and business-friendly environment, positions Cyprus as an excellent choice for entrepreneurs and companies looking to establish a presence in the European market.

You can see more information on the tax benefits in Cyprus in our Why Cyprus article.

As from 31/12/2022, every Cyprus Company upon incorporation will be considered a Cyprus Tax Resident, unless the said Company is tax resident in another jurisdiction.

In accordance with current the Income Tax Law, a company is considered to be a tax resident of Cyprus if its management and control is exercised in Cyprus.

The existing corporate tax residency test will continue to apply, so that a company that has its management and control in Cyprus will continue to be considered as a tax resident of Cyprus. It is always recommended to have strong substance in Cyprus in cases of a tax audit from foreign tax authorities (i.e. of the country of tax residency of the CyCos beneficiaries). For more information on substance in Cyprus please click here.

The above are provided for indicative purposes only and do not constitute any form of advise. Please contact us for more information and specialized advise on Cyprus Company Incorporation matters.

GET STARTED TODAY

We at Asterisk Corporate Services help businesses and entrepreneurs set up and manage companies in Cyprus. We provide the service we would like to experience ourselves. Contact us today and we will assist you.